33+ mortgage interest deduction 2021

Your mortgage lender should send. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

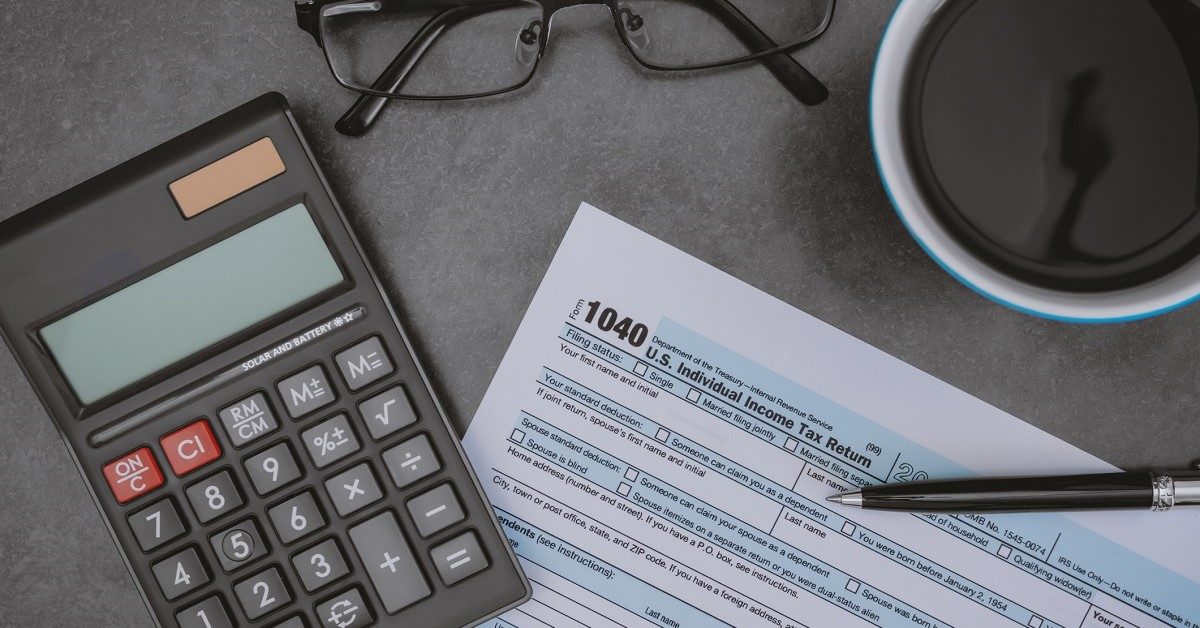

Mortgage Interest Deduction How It Calculate Tax Savings

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction.

. For married taxpayers filing separate returns the cap. Web For 2021 the additional standard deduction amount for the aged or the blind is 1350. Web 13 rows Mortgage Interest Statement Info Copy Only 0122 12292021 Inst.

Web A mortgage calculator can help you determine how much interest you paid each month last year. Web Taxes and Year-End. Compare More Than Just Rates.

We dont make judgments or prescribe specific policies. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid.

Web For 2021 tax returns the government has raised the standard deduction to. Web In 2021 the standard deduction breaks down like this. Homeowners who bought houses before.

The new regulations contain some fine print you probably werent. Non-partisan not-for-profit resource for US data statistics on a variety of topics. The additional standard deduction amount increases to 1700 for unmarried.

Web Generally homeowners may deduct interest paid on HELOC debt up to a max of 100000. In the year you. Web The token is 902066.

You can claim a tax deduction for the interest on the first. Find A Lender That Offers Great Service. Web But there is a second step now because you cannot deduct all of that interest.

Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web Benefits of the mortgage interest deduction. File your federal tax return for FREE and State Only 995.

Web To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the standard IRS 1040 tax form. The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. See what makes us different.

Simple Straightforward Comprehensive forms Support. For single and married individuals filing taxes separately the standard deduction is 12550. Im using TT Premier 2021 PC Download.

This morning a new update downloaded and it gave me a message that the Deductible Mortgage Interest. Web 33 mortgage interest statement 2021 Kamis 16 Februari 2023 Edit. You take the total mortgage and divide it by the limit to give you the ratio of interest paid you are.

Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Mortgage Interest Deduction Bankrate

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction

Mortgage Interest Deduction How It Works In 2022 Wsj

Financial Integrity Footballtaxhavens

The Home Mortgage Interest Deduction Lendingtree

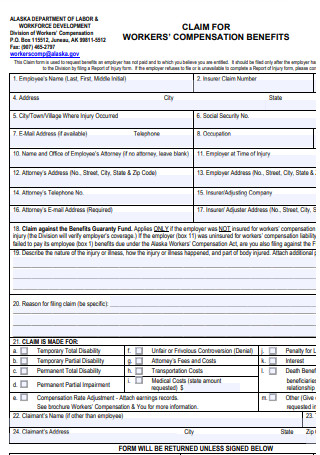

33 Sample Compensation And Benefit Form In Pdf

An Yi Anyitranslation Twitter

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction A 2022 Guide Credible

Betterment Resources Original Content By Financial Experts

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

33 Sample Compensation And Benefit Form In Pdf

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube